Will the Grinch Steal Your Equity? The Current Chicago Real Estate Market

Merry Christmas and Happy Holidays! I hope everyone has a fantastic holiday and wish you the best for 2023.

This is Part One of a Two-Part Series. The focus is on key statistics that show where were in the last few years and how its slowing down now. Part Two will focus on the 2023 Chicago Real Estate Predictions, including the prognosis from all the real estate industry leaders and my own.

The Era of Quick Sales is Over

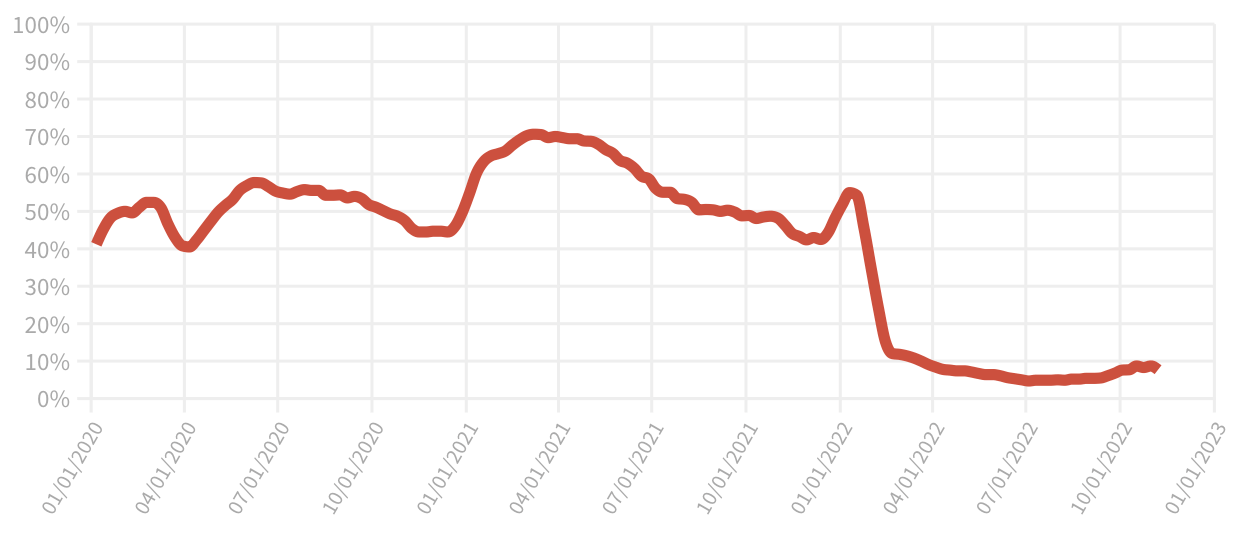

From late spring 2020, when the pandemic-era housing boom kicked in, through early 2022, about half the homes that sold in the Chicago metro area landed buyers in two weeks or less, according to Redfin. The figure was rarely below 45%, and in spring 2021, it was running about 70%.

Then in February 2022, it was clear the Federal Reserve would raise interest rates to try to stifle inflation. Within a month, quick sales tumbled to 12%. Then below 10% in April where it remains. On the street, I am shocked to see the long market times and price drops. Buyers in the market might have higher rates, but a more normal and relaxed shopping experience: 2nd showings and real negotiations.

Percent of Chicago Area Real Estate Listings Off Market in Two Weeks

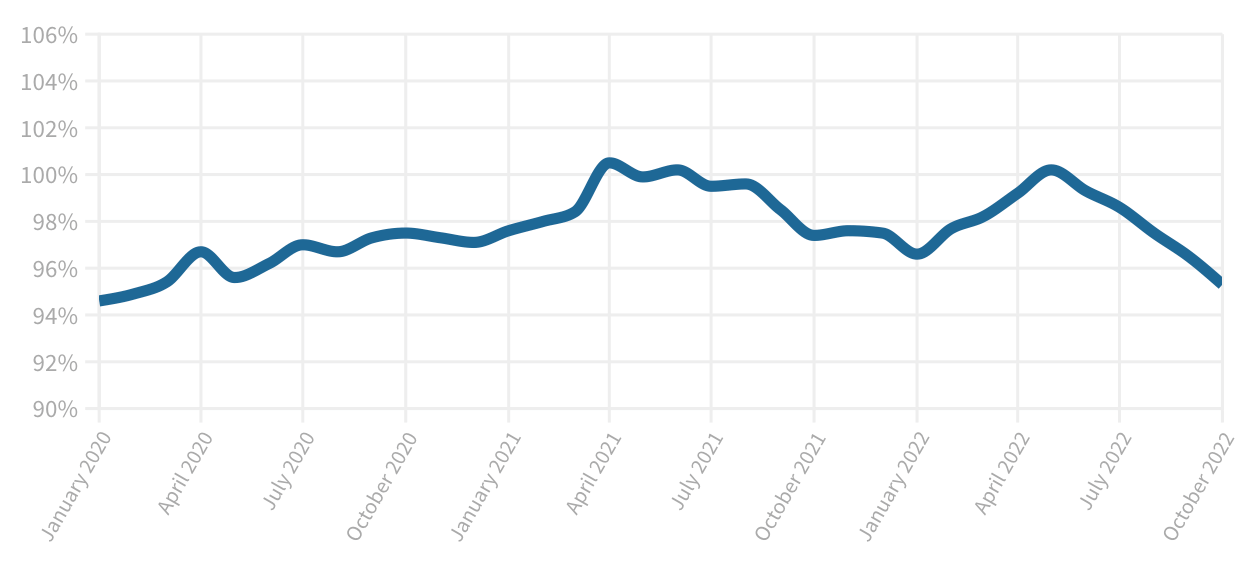

Buyers Can Finally Negotiate Down From Full Asking Price

Fierce bidding wars characterized the housing boom, as buyers fueled by cheap rates felt they could afford more, so they’d pay more to get the home they wanted.

In spring 2021, homes in both the city and suburbs were selling for a little more than 100% of their full asking price, a figure that had never before been seen in price records that go back to the start of 2007.

No more.

As this chart shows, houses have been selling for a smaller percentage of the asking price month after month since May, when the impact of interest rates really began to be felt.

By October, sale prices on Chicago houses were averaging about 95% of the asking price, right back where they were in the months before the dawn of the boom.

Percent of Original List Price Received

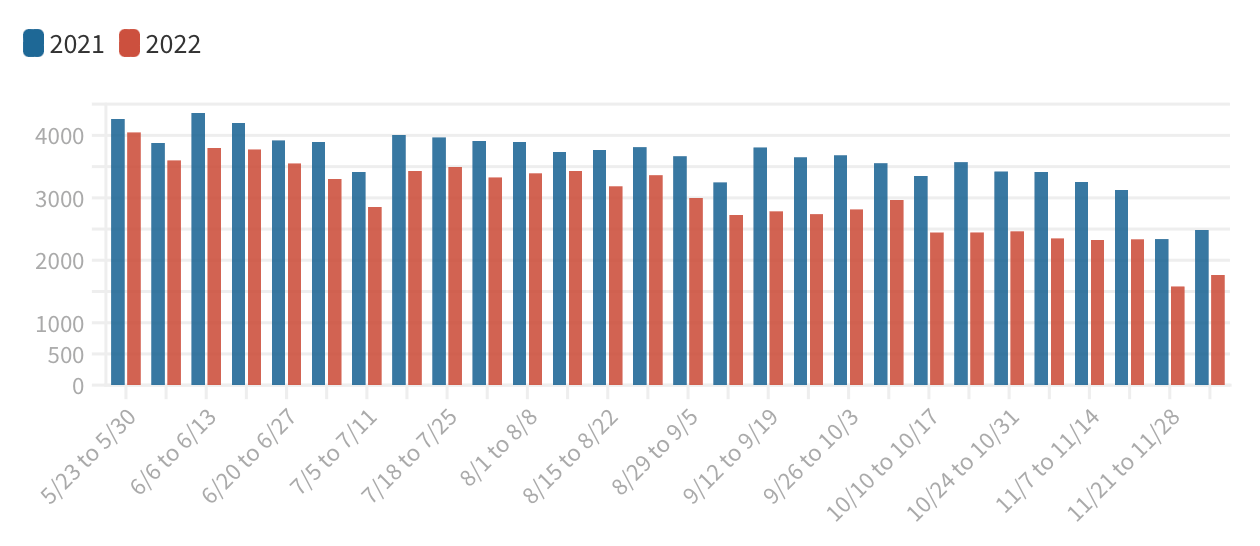

Buyer activity slowed sharply

In the last few months of 2021, buyers were putting more homes under contract than they had a year earlier—which itself had been a record high volume time. Sales growth was coming on top of sales growth.

In early 2022, interest rates rose fast under the Fed’s effort to thwart inflation. There was and is lots of Recession talk and buyers slowed down.

By fall, the number of homes that buyers put under contract dropped below the pace of pre-Covid 2019.

Chicago-Area Residential Properties Under Contract