Top Five 2022 Market Outlook Takeaways for Chicagoland

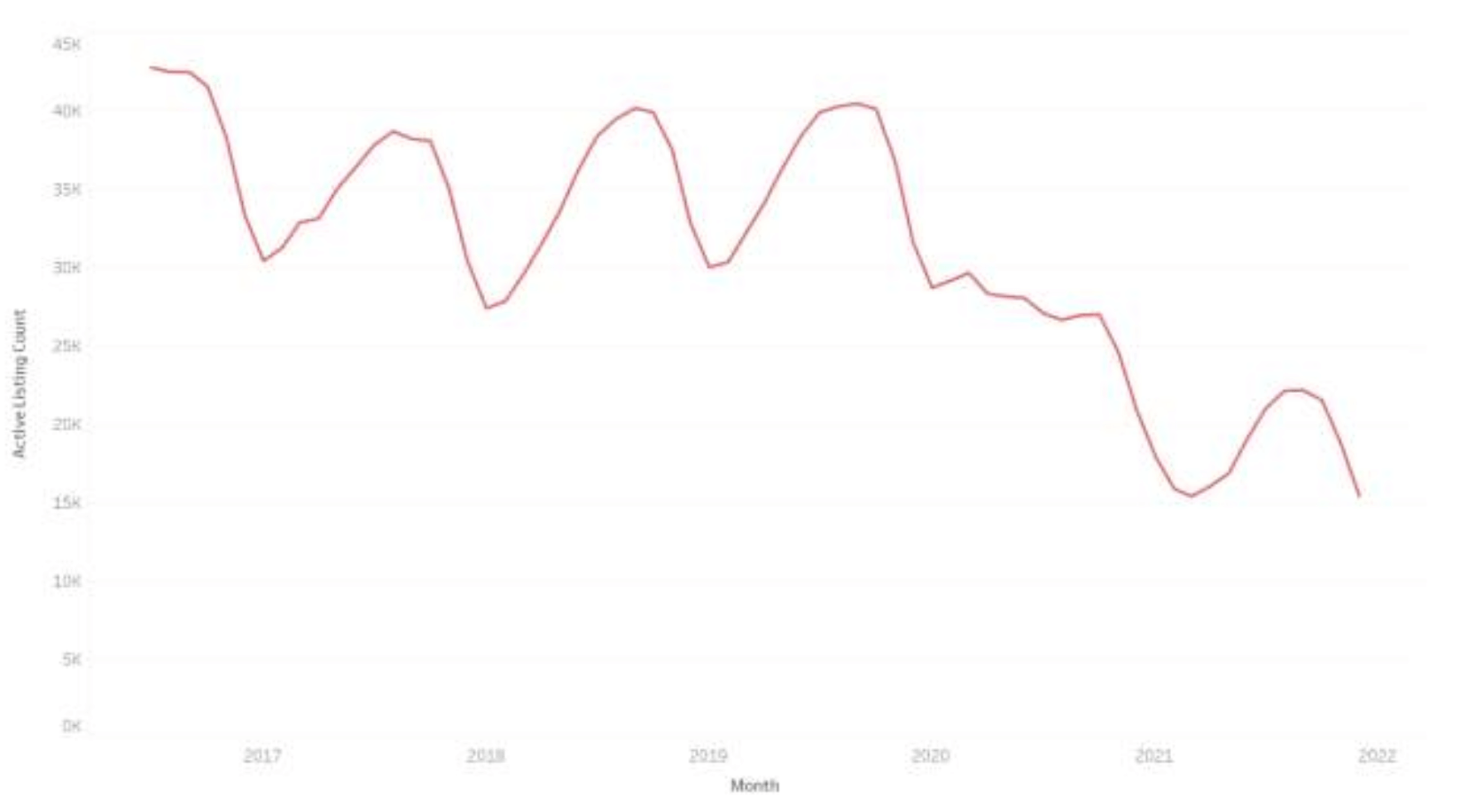

1. The Worst of the Inventory Strain Has Passed, But Inventory Will Still Be a Challenge

The Chicago metro area had 15,400 homes for sale in December 2021 compared to 31,600 homes in December 2016. Intense housing demand has fueled shortages. The number of homes for sale is down 26% compared to 2020.

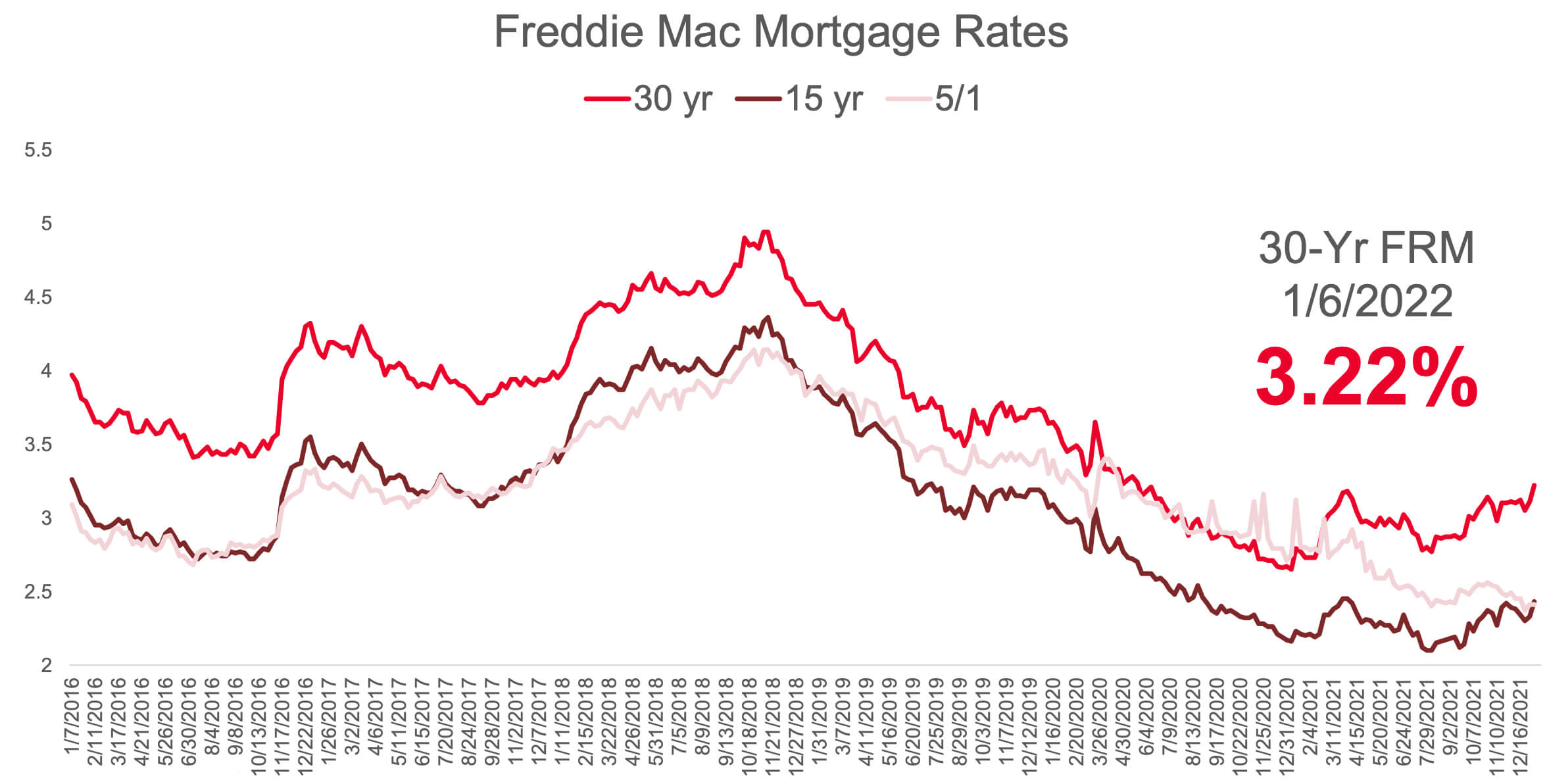

2. Mortgage Rates are Anticipated to Rise

Mortgage rates are still low, but we are starting to see them creep back up.

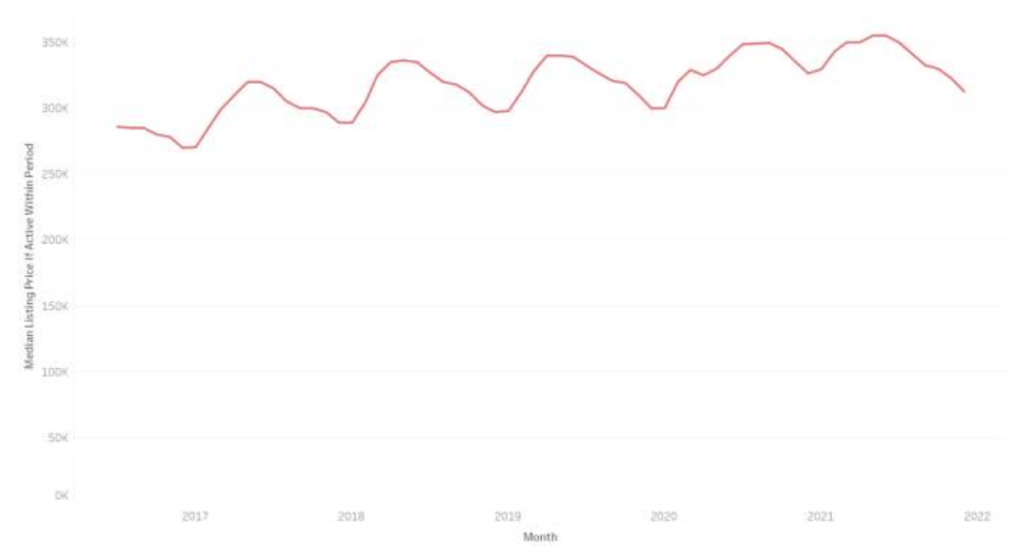

3. Affordability Challenges Ahead

The median listing price in Chicago was $312,500 in December of 2021. Even though that is down 4.2% from December of 2020, the clear trend shows an upward trajectory of home prices.

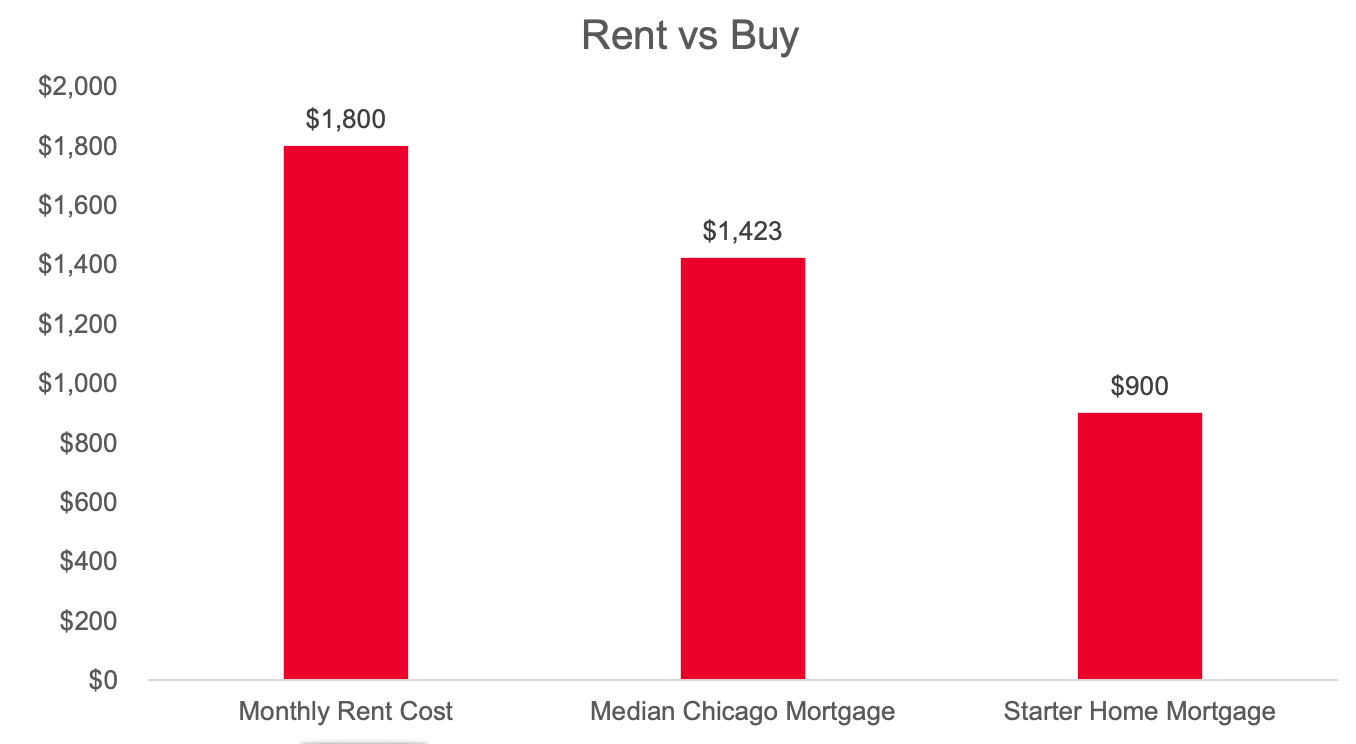

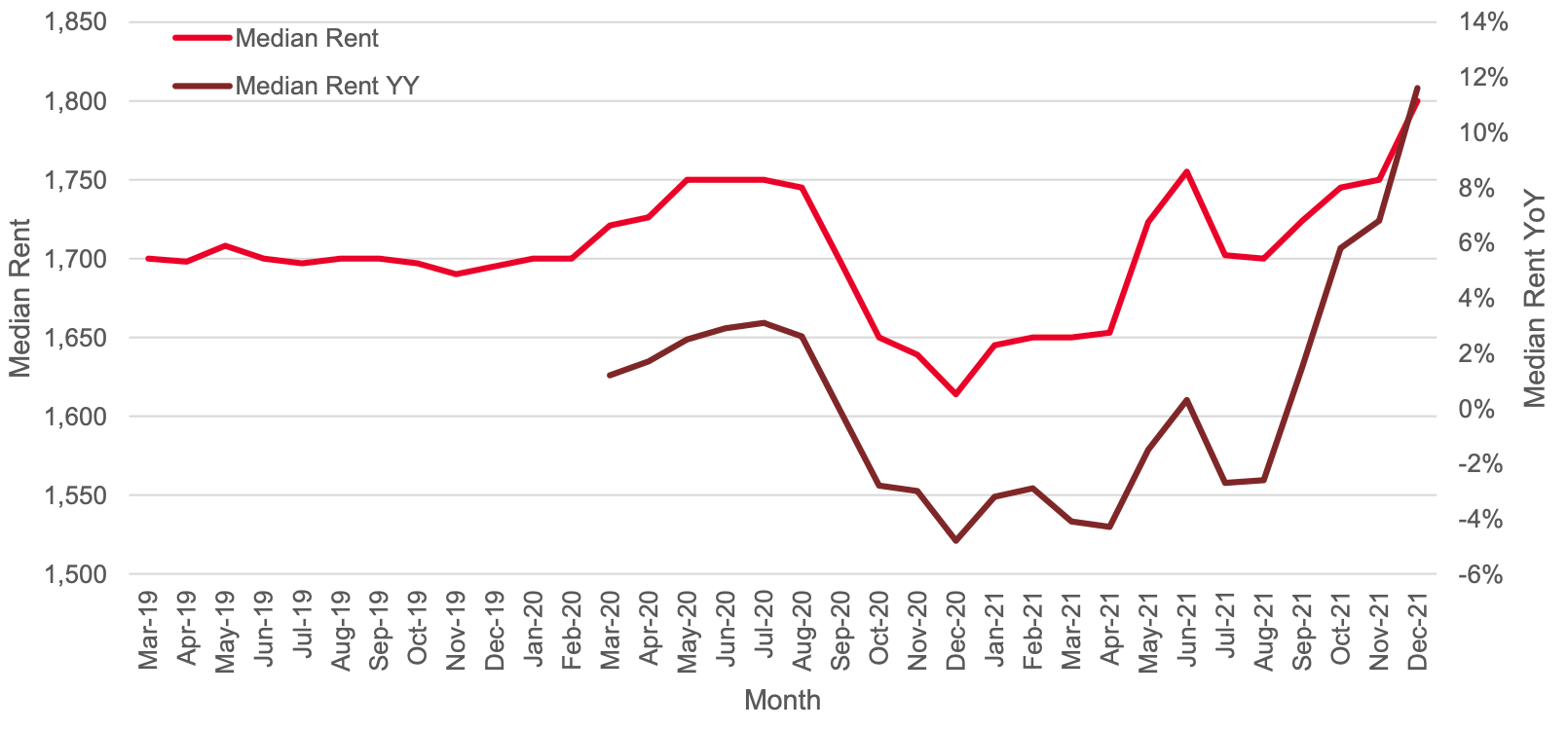

4. Rent Prices Will Continue to Increase

The average rent in December 2021 was $1,800 per month. This is up 11.6%, the highest level since the start of the pandemic.

5. Despite Challenges, 2022 Will Be a Great Year for the Market

Buying is still a far better and more affordable option than rending. Median mortgage prices are lower than median rents. The mortgage of a starter home can cost 1/2 as much as the median rent!