A Great Reset? What’s Next for 2026 Chicagoland Realty

A Great Reset? What’s Next for 2026 Chicagoland Realty?

In 2026, the Chicagoland housing market will improve, but at a snail’s pace. Most predictions are for slow but steady improvement in inventory, sales and affordability. For many buyers, this has been a long time coming. But obstacles remain. And in some areas in high demand like the Northside, there will be no reset.

|

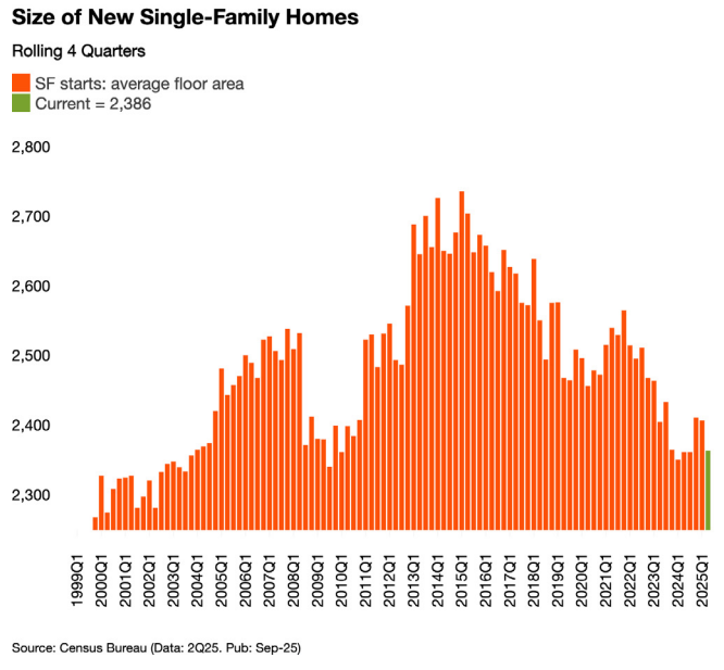

NATIONAL PREDICTIONS Most outlooks for home sales are within a narrow band of modest year-over-year growth, except for one outlier. Whereas Realtor.com has the lowest projected sales increase, at 1.7%, followed by Redfin, at 3%, and Zillow, at 4.6%, National Association of REALTORS® Chief Economist Lawrence Yun is predicting a hefty 14% surge in sales. Price Growth Slow and 6% Interest Rates NAR has a relatively bullish estimate at 4%, compared to Realtor.com (2.2%), Zillow (1.2%) and Redfin (1%). Interest rate projections all point to a 30-year mortgage rate of 6% to 6.3% following the three cuts of fall/winter 2025. Zillow predicts the average mortgage rate will be “above 6%” in 2026, while NAR predicts it to be “around 6%,” and Redfin and Realtor.com both expect an average rate of 6.3%. As interest rates gradually come down, buyer confidence should increase, which will help move demand that’s been building as buyers and sellers have stayed put. New Construction Will Be Smaller But More Affordable According to the Urban Land Institute’s 2026 Emerging Trends in Real Estate report, builders’ most significant challenge is building affordable homes. The answer seems to be smaller homes with fewer features and upgrades. Buyers are now willing to sacrifice home size and finish quality in exchange for price relief, according to the report. |

|

Accordingly, more than 60% of current home shoppers said they’d opt for a smaller home to buy a new one, ULI said, citing a survey by John Burns Research and Consulting. The average size of a new single-family home fell to 2,386 square feet in the second quarter of 2025 from a high of 2,692 square feet in 2016. Some builders are lowering the spec level of homes to cut costs, ULI said, noting one builder is lowering ceiling height and providing fewer windows and lower-finish countertops to save on costs — with little pushback from affordability-minded buyers. |

|

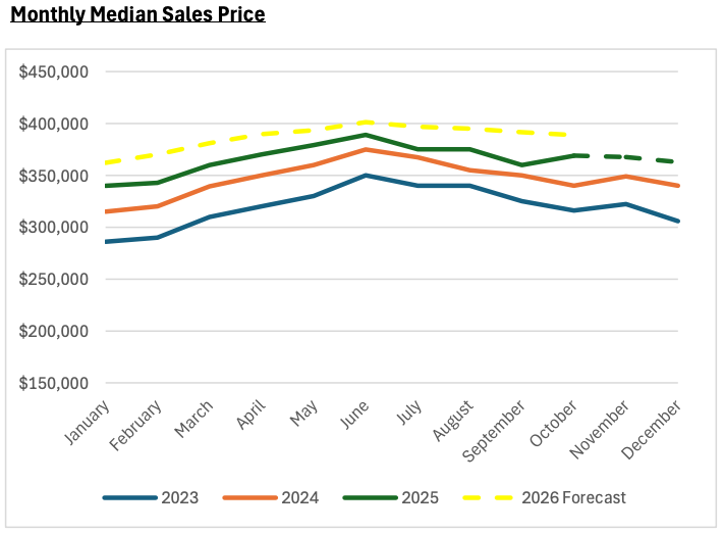

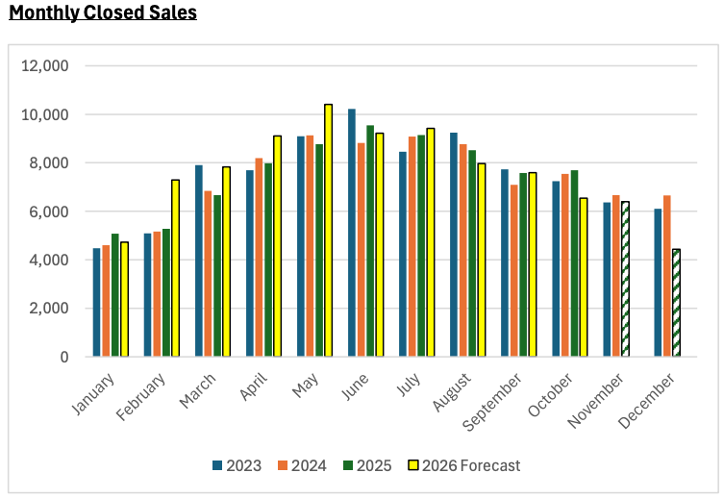

Will Chicagoland Reset? Sales and sales prices in Chicagoland are predicted to be stronger than the nation as a whole, as we continue to struggle with lack of inventory. DePaul’s Institute for Housing Studies expects closed sales to rise 5.1% to 80,116 through the year ending in October 2026. The median sales price is forecast to rise almost 5% over that time, from $369,051 to $386,972. |

|

via Illinois REALTORS®. Statewide, Illinois sales are expected to rise about 1% year over year through October 2026 to 114,187, while the median sales price is forecast to climb 3.4% to $317,487, according to the DePaul study. |

|

No Reset for Certain Micro-Markets These broad, local market trends will not apply across the board in Chicagoland. Chicagoland is filled with micro-markets. In the city, the near north neighborhoods like Lincoln Park may continue to suffer from acute lack of inventory and extreme demand as sellers stay put with their pre-Covid 3% interest rates. High demand suburbs with good schools and a train station like Arlington Heights may continue to challenge buyers wanting affordable homes. Buyers should expect to pay a premium in many of the more popular areas. If you are buying and selling in 2026, it is important to review the monthly sales reports that I include in my reports, as they drill down into your micro-market. OBSTACLES TO GREAT RESET PERSIST There are still some obstacles to the Great Reset. Real estate agents will still have to deal with unrealistic buyers hoping for pre-Covid prices and inventory and sellers wanting sky high post-COVID peak prices. Will expectations between buyers and sellers align? There is also uncertainty more broadly in the economy impacting real estate. “[A] substantial level of uncertainty continues to surround the housing market, making conditions in 2026 difficult to predict,” said Geoff Smith, executive director of DePaul University’s Institute for Housing Studies. “The trajectory of federal interest rate policy remains unclear, inflation and broader economic volatility continue to weigh on consumer confidence, and housing affordability challenges persist for a wide range of potential homebuyers.” |