National 2024 Housing Market Forecasts

No one really knows for sure what the national mortgage market will bring in 2024, we’ve summarized the forecasts offered by top housing economists.

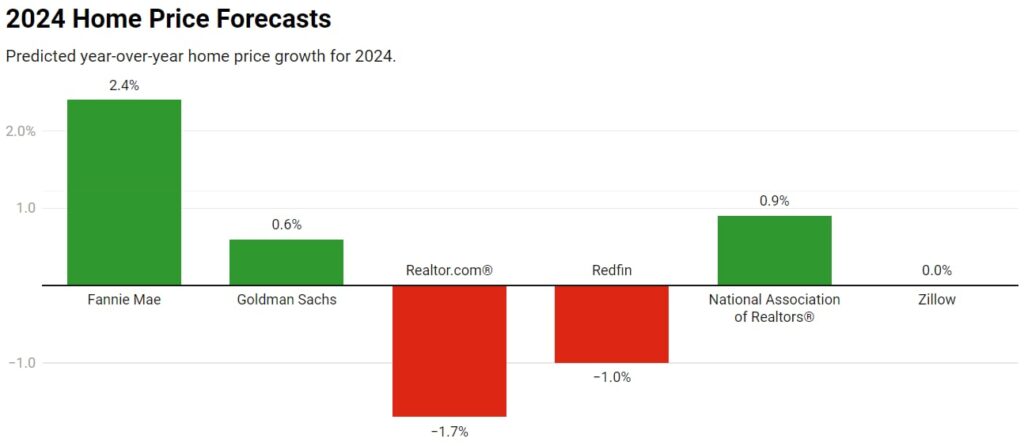

HOME PRICE PREDICTIONS

Housing economists do not expect home prices to see drastic changes in 2024. At the low end, Redfin expects home prices to decline 1.7%, while Fannie Mae expects that home prices will increase by 2.4% in 2024.

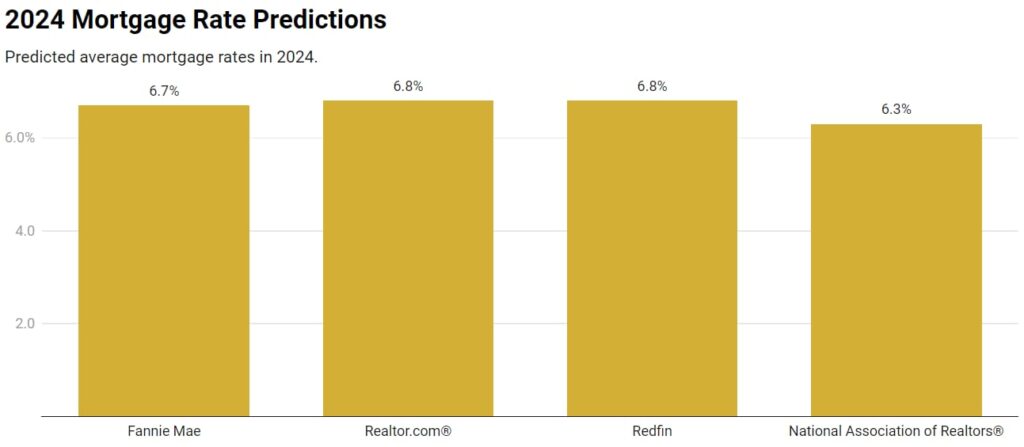

2024 MORTGAGE RATES

Housing economists all expect mortgage rates to remain between 7% and 6% in 2024.

FANNIE MAE’S 2024 HOUSING MARKET FORECAST

- Home sales will remain suppressed due to comparatively high mortgage rates and low inventory levels. Increases in new construction and builder concession have boosted new home sales to an unexpected degree in 2023.

- Because of that, Fannie Mae anticipates new home sales will drop only slightly in 2024 due to a modest contraction of the U.S. economy.

- They also expect the shortage in existing homes to drive up new home construction in the medium term.

- Home Prices: According to the Q4 2023 Fannie Mae Home Price Expectations Survey, housing experts expect home prices to increase by 2.4% in 2024 and 2.7% in 2025.

- Mortgage rates: The ESR Group expects the average 30-year fixed mortgage rate (FMR30) of 6.7% in 2024 and 6.2% in 2025.

- Purchase and refinance mortgage originations are expected to decline in the first two quarters of 2024 before rebounding in Q3 and Q4 2023 and climbing even higher in Q2 2025.

Clearly, the many economic forecasters who previously forecasted a recession beginning in 2023 were wrong, including us. However, we continue to think there are reasons for concern that will likely lead to a mild economic downturn, including stretched consumer spending relative to personal incomes and the continued effects of restrictive monetary policy still working through the economy. Although we expect headline growth to clock in at 2.6 percent in 2023—above what is generally considered to be the economy’s long-term growth potential of 1.8 percent—we’re also forecasting slightly negative growth in 2024.

Notwithstanding the recent mortgage rate rally, housing and mortgage markets will enter 2024 at approximately the same level as they entered 2023. Thus, while we think home sales will start to rise over the new year, the combination of modest increases in home prices and still-elevated interest rates suggest a slow pace of recovery from previously recessionary levels of housing activity.

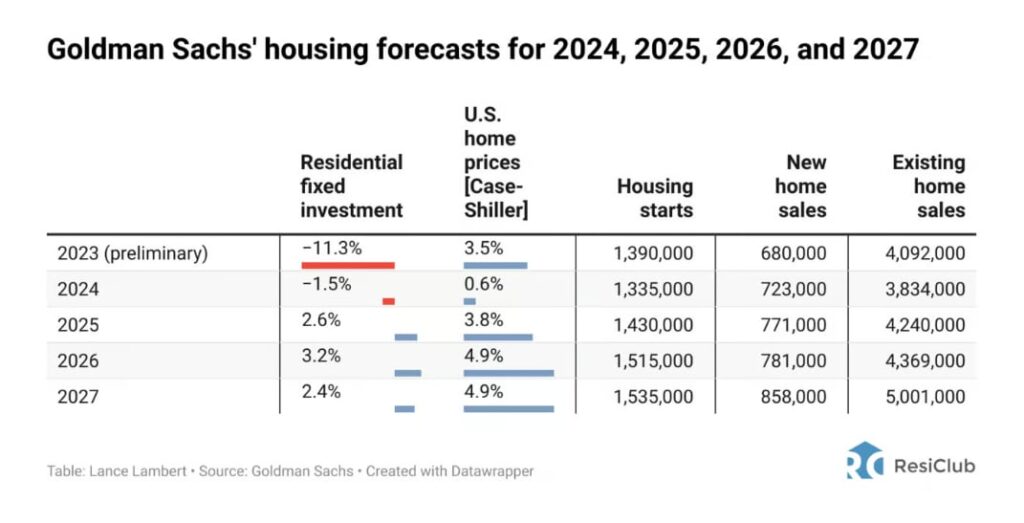

GOLDMAN SACHS’ HOUSING MARKET PREDICTIONS

- Home sales will remain suppressed through 2026, with total transactions not reaching 5.0 million until 2027

- Chief economist Jan Hatzius expects Jerome Powell to announce the first Fed rate cut in the third quarter of 2024—a slight upgrade from his earlier estimate of Q4 2024.

- Hatzius expects a soft landing for the U.S. economy, but he also believes mortgage rates and the 10-year Treasury yield will remain elevated for the next few years.

- Despite bearish numbers for U.S. home sales for 2024-2027, the forecast shared by Hatzius shows home values increasing for the next four years.

REALTOR.COM®’S HOUSING MARKET PREDICTIONS

- Home prices are expected to drop 1.7% year over year in 2024. That combined with lower mortgage rates and income growth should contribute to improved affordability.

- Mortgage rates will average 6.8% for the year, reaching 6.5% by the end of 2024.

- For sale inventory will drop 14.7% in 2024, while new construction and rentals provide alternative options for home seekers.

- As renting remains a more budget-friendly option for many would-be homebuyers, Realtor.com expects the median asking rent to drop 0.2% year over year in 2024.

- Home sales for 2024 will hold around 4 million, with a slight 0.1% uptick.

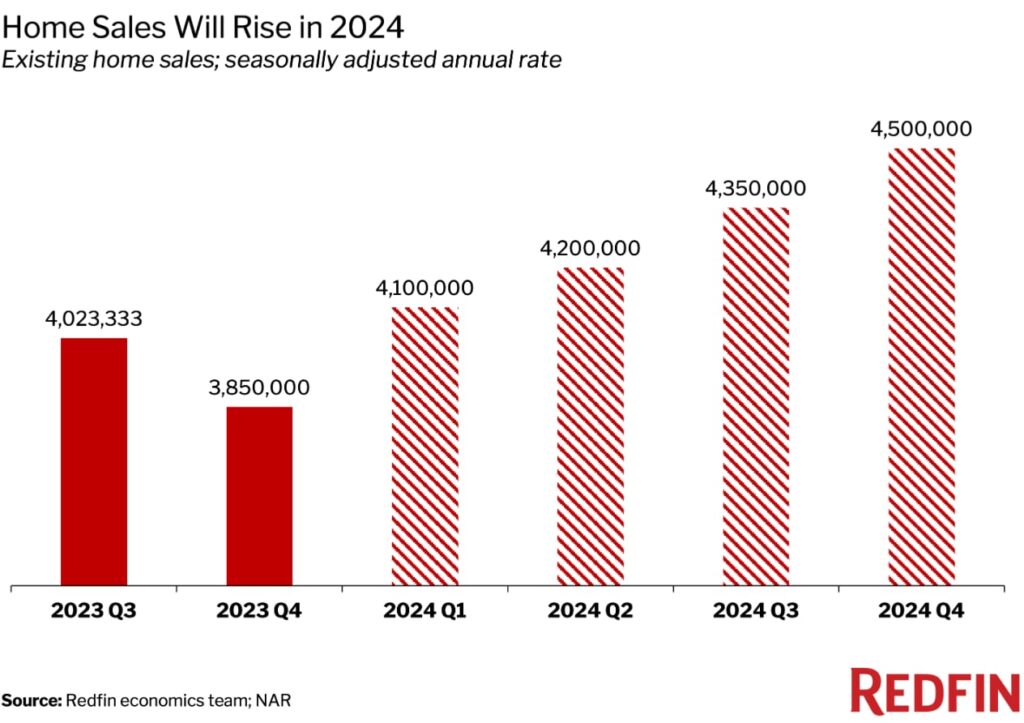

REDFIN’S 2024 HOUSING MARKET PREDICTIONS

- Home prices will fall 1% year over year during the second and third quarters of 2024, marking the first home price drop since 2012, with the exception of the brief decline in 2023.

- Mortgage rates will fall in 2024 but remain above 6%, averaging 6.6% in Q4 2024.

- Redfin economists expect an increase in new listings as the mortgage rate lock-in effect diminishes.

- As affordability challenges remain for many, Redfin expects an increase in demand for larger rental apartments and single-family rentals.

- Home sales will increase by 5% year over year in 2024, reaching a total of 4.5 million in the fourth quarter. The momentum will begin in Q1 and will build as the year progresses, driven by improved affordability and an increase in new listings.

NAR 2024 HOUSING MARKET FORECAST

- Existing home sales will rise 13.5% from 2023 to 4.71 million in 2024

- A 0.9% annual increase will bring the national median home price to $389,500.

- Mortgage rates will continue falling, with an average 30-year fixed rate of 6.3% in 2024.

- Housing starts will reach 1.48 million, including 1.04 million single-family homes and 440K multifamily units.

- The #1 market to watch in 2024 (and beyond): Austin, TX

The demand for housing will recover from falling mortgage rates and rising income. In addition, housing inventory is expected to rise by around 30% as more sellers begin to list after delaying selling over the past two years. The selected top 10 U.S. markets will experience faster recovery in home sales.

ZILLOW’S 2024 HOUSING MARKET PREDICTIONS

- As homeowners acclimate to the reality that mortgage rates aren’t likely to drop back down to 2-3%, Zillow expects an increase in new listings, especially as the lock-in effect loses some of its power.

- Home price growth will be nearly flat in 2024, and home buying costs will level off as mortgage rates decline.

- More affordable homes will still see plenty of competition.

- The new starter home will be a single-family rental, evidenced by a surge in rental demand, especially for single-family homes and rentals in walkable downtowns.